Market Linked SecuritiesLeveraged Upside Participation See The Estimated Value of the Securities in this pricing supplement. The estimated value is less than the principal amount of the securities. Our estimated value of the securities on the Pricing Date, based on our internal pricing models, is $915.00 per security. See Supplemental Plan of Distribution in this pricing supplement and Use of Proceeds and Hedging in the underlying supplement for information regarding how we may hedge our obligations under the securities. In addition to the selling concession allowed to WFA, the agent will pay $1.20 per security of the underwriting discount to WFA as a distribution expense fee for each security sold by WFA. Such securities dealers may include Wells Fargo Advisors (WFA) (the trade name of the retail brokerage business of Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, each an affiliate of Wells Fargo Securities). The agent may resell the securities to other securities dealers at the principal amount less a concession not in excess of $25.00 per security. The agent, Wells Fargo Securities, LLC (Wells Fargo Securities), will receive an underwriting discount of $40.50 per security. Any representation to the contrary is a criminal offense. Neither the Securities and Exchange Commission (the SEC) nor any state or provincial securities commission has approved or disapproved of these securities or determined if this pricing supplement or the accompanying underlying supplement, prospectus supplement and prospectus is truthful or complete. The securities are not bail-inable debt securities (as defined on page 6 of the prospectus ). Federal Deposit Insurance Corporation or any other government agency or instrumentality of Canada, the United States or any other jurisdiction. The securities will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. The securities are unsecured obligations of Canadian Imperial Bank of Commerce and all payments on the securities are subject to the credit risk of Canadian Imperial Bank of Commerce. See Risk Factors beginning on page PRS-8 herein and beginning on page S-1 of the accompanying underlying supplement, page S-1 of the prospectus supplement and page 1 of the prospectus. The securities have complex features and investing in the securities involves risks not associated with an investment in conventional debt securities. No exchange listing designed to be held to maturity No periodic interest payments or dividends Investors may lose some or all of the principal amountĪll payments on the securities are subject to the credit risk of Canadian Imperial Bank of Commerce and you will have no ability to pursue any securities included in the Index for payment if Canadian Imperial Bank of Commerce defaults on its obligations, you could lose all or some of your investment If the level of the Index decreases by more than 40%, you will have 1-to-1 downside exposure to the decrease in the level of the Index from the Starting Level, and you will lose more than 40%, and possibly all, of the principal amount If the level of the Index does not change or decreases but the decrease is not more than 40%, you will be repaid the principal amount

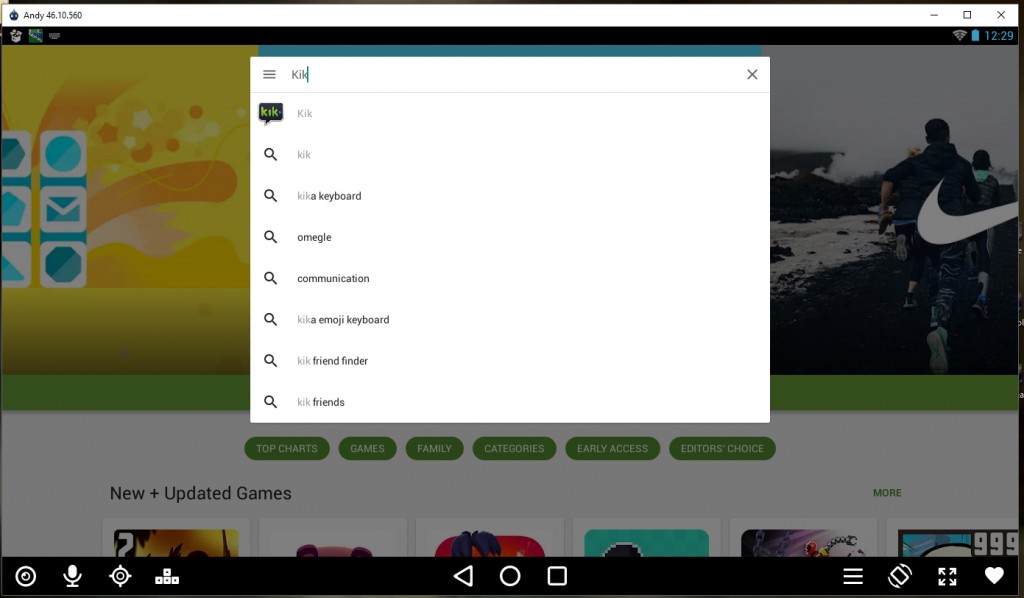

#W T T KIK FOR PC PLUS#

If the level of the Index increases, you will receive the principal amount plus 115% participation in the upside performance of the Index

Instead, the securities provide for a payment at maturity that may be greater than, equal to or less than the principal amount of the securities, depending on the performance of the Index from its Starting Level to its Ending Level. The payment at maturity will reflect the following terms: Unlike ordinary debt securities, the securities do not pay interest or repay a fixed amount of principal at maturity. Linked to the S&P 500 ® Index(the Index)

Principal at Risk Securities Linked to the S&P 500 ® Index due May 1, 2026 Market Linked SecuritiesLeveraged Upside Participation and Contingent Downside (To Equity Index Underlying Supplement dated December 16, 2019, Prospectus Supplementĭated December 16, 2019 and Prospectus dated December 16, 2019)

0 kommentar(er)

0 kommentar(er)